MoneyTime – Best Non-Financial Services Companies Runner-up | The MAIAs 2022

It is never too late for people to learn about financial literacy, but starting young is ideal and making it fun is even better.

Michael Gilmore, a MAIAwards co-founder, said, “We love the concept and approach of MoneyTime. Its self-directed learning modules are aimed at 10- to 14-year-olds with a sophisticated learning element. This is a great age to start learning about money, and making it enjoyable will encourage kids to keep going.”

The MAIAwards judges liked the MoneyTime program so much that they gave it a runner-up award in the Best Non-Financial Services category!

Neil Edmond, the CEO of MoneyTime, knows there is a knowledge gap for many people regarding financial literacy. He says, “Regardless of their country, most parents weren’t taught about money, so they find it hard to teach it to their kids. As a result, children grow up financially ignorant and have to learn about money the hard way. They are missing opportunities to improve their financial well-being due to naivety and a lack of confidence.”

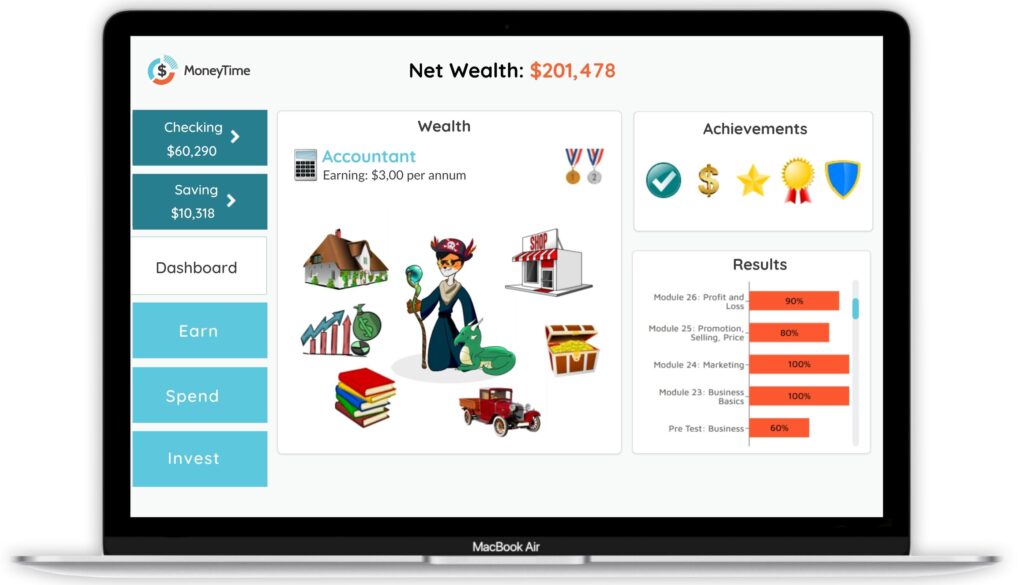

To resolve this, Neil established MoneyTime, an online financial literacy program for 10- to 14-year-old kids. The program is modular and available online for anyone to use, whether at home or school. In addition, the content is constantly updated by MoneyTime’s highly experienced team.

To resolve this, Neil established MoneyTime, an online financial literacy program for 10- to 14-year-old kids. The program is modular and available online for anyone to use, whether at home or school. In addition, the content is constantly updated by MoneyTime’s highly experienced team.

“We’ve spent the last three years refining the program and regularly review student results and rewrite material where testing shows students consistently answer questions incorrectly. There is also an app in development to further expand the program’s reach,” Neil says.

“MoneyTime includes 13 modules specifically designed for children to do with their parents. These ensure their learnings are put in their family’s real-world context. Also, the content is localised for every country, so it is directly relevant to every student.”

What makes the program so unique is its approach. MoneyTime’s combination of being digital, self-taught, and gamified makes the platform easy to access and enticing to use. The results are constantly assessed, as are the learning outcomes. As a result, the program is proving remarkably effective.

“We have 30 student lessons divided into eight topics. There is a 15-question multi-choice test at the beginning of a topic and the same test at the end. The difference in scores represents the knowledge increase from completing the modules in the topic. MoneyTime has produced an average 44% increase in knowledge across 50,000 users,” Neil explains.

The program has already been used in 720 primary schools in New Zealand, with over 50,000 students and 1400 home users having completed the course. It is now expanding internationally, and Neil has grand plans for the future.

“We are looking to financially educate a whole generation globally. MoneyTime was created in New Zealand, but the lack of financial literacy is an international issue. The program is built for scale so we can realise our vision worldwide,” Neil says.

“We currently promote the program directly in New Zealand and have reseller partners in South Africa, Australia, India, Indonesia, and the US. Our South African partner is poised to distribute the program throughout Africa. Within the next three years, we plan to be in Canada, the UK and Asia.”

The testimonials and responses to MoneyTime have been universally positive, with kids eager to learn more. We hope that a MAIAward will help spread the word.

Michael Gilmore said, “The judges and I were impressed by the MoneyTime program and its engaging approach. As it is digital and will soon expand via an app, it is also easily scalable. We look forward to seeing the course roll out globally.”

For more information about MoneyTime, you can visit their website or email us at michael@www.maiawards.org.